Elon Musk, the entrepreneur and CEO of Tesla, SpaceX, and Neuralink, has long been vocal about his concerns over the potential dangers of artificial intelligence (AI). In fact, he recently laid out the threat in bare terms, warning that AI could not only cause job loss and reorganize the workforce, but it could also lead to World War III.

Binance in Trouble: Allegations of Legal Breaches in US and China

Binance, one of the world's largest cryptocurrency exchanges, is currently facing legal troubles on multiple fronts. According to reports, the exchange is accused of evading federal laws and operating illegally in both the United States and China.

Binance’s Secret US Users

The US Commodity Futures Trading Commission (CFTC) revealed that Binance had three million US users by mid-2020, despite its public stance that it did not allow US users to trade. This revelation could have serious consequences for the exchange, as it could face fines or even lose its ability to operate in the US market.

USA’s Unexpected Ally in the Fight Against Binance

Binance employees have allegedly been helping Chinese users evade the exchange's know-your-customer (KYC) verification process, according to CNBC. KYC processes are put in place to verify the identity of users and prevent illegal activities such as money laundering. If the allegations are true, it could mean that Binance was knowingly facilitating illegal activity in China.

SBF Alleged $40M Bribe to Chinese Officials

According to the CNBC, Sam Bankman-Fried, founder of cryptocurrency exchange FTX, has been accused of paying a $40m bribe to unfreeze accounts linked to Alameda Research. This accusation has further fueled concerns about the lack of regulation and transparency in the cryptocurrency industry.

Chinese Blockchain Executive’s Rape Charges

According to the MAGZINE by Coin Telegraph, Jun Yu, founding partner of Web 3.0 fund A&T Capital, is under investigation for rape charges. This highlights the need for increased scrutiny and accountability within the cryptocurrency industry, as well as the importance of proper background checks and due diligence when investing in cryptocurrency ventures.

Binance's legal woes have brought to light some of the issues facing the cryptocurrency industry, including lack of regulation and transparency, as well as potential facilitation of illegal activities. The allegations against Binance and other industry leaders highlight the need for increased scrutiny and accountability in the cryptocurrency world. Investors and users must do their due diligence and carefully assess the risks before engaging with any cryptocurrency platform or venture. As the industry continues to evolve and face challenges, it is up to all stakeholders to work towards a more secure and trustworthy cryptocurrency ecosystem.

Former President Donald Trump Indicted by Manhattan Grand Jury for Hush-Money Scheme

Indictment Details:

Political Fallout:

Possible Implications:

Introducing ZetaChain: Connecting All of Crypto and Price Pool of More than $1000000?

ZetaChain is the world's first and only public blockchain that connects all other blockchains, making it easy and accessible for everyone. With ZetaChain, you can access all your assets, data, and liquidity in one place, without having to worry about technical jargon or complex processes.

That's where ZetaChain comes in!

- Cryptocurrency can be confusing and overwhelming with all the different blockchains and digital assets available.

- But what if there was a single entry point that connected all of crypto in a secure and user-friendly way?

Developers can also benefit from ZetaChain's unique features, such as cross-chain transactions, over 150 deployed DApps, and more than 1Million testnet users. ZetaChain makes it easy for developers to build and deploy apps that work across all chains, from a single place.

ZetaChain's simplicity is one of its key advantages in a complex industry. You can interact with the entire web3 ecosystem in one place and minimize the risk of attacks on your funds. Plus, ZetaChain is the only public, decentralized blockchain and smart contract platform that enables message passing and value transfer between any blockchain, including non-smart contract chains like Bitcoin and Dogecoin.

ZetaChain is revolutionizing the world of cryptocurrency by connecting all of crypto on a single blockchain, making it easy and accessible for everyone. As the world of crypto continues to evolve, ZetaChain is leading the way with its innovative features and commitment to interoperability and accessibility.

But that's not all about Zetachain, Zeta team will also offer rewards to their testnet users and crew participants at the end of their testnet but users are in millions so you need to increase your rank by following our blog.

Follow the Steps

Airdrop Process 1:

- Go to Zeta Testnet link and verify your Twitter account, Once verified, you will receive 5000 Zeta points If you follow some one's link.

- Connect your Metamask Wallet.

- Then apply for testnet tokens.

- Swap the tokens weekly to receive 7000 points on each swap.

- Refer your friends to earn 5000 points each and increase your rank.

Airdrop Process 2:

- Claim all testnet Oats on GALXE

Airdrop Process 3:

- Join Zeta Crew .

- Follow and interact with their tweets to increase your XP and rank.

Payday secures $3m seed funding round to expand its operations and power the future of work for Africa

According to several News including Business Insider Africa; Payday, a Pan-African neobank raised $3 million in a seed funding round to expand its operations and revolutionize the future of work in Africa. The neobank's growth strategy includes marketing, talent acquisition, and providing borderless payment alternatives in major currencies. Payday's partnership with Starlink aims to help Africans purchase internet connections seamlessly and participate in the global digital economy.

Rwandan-based neobank Payday has raised $3 million in a seed funding round to revolutionize the future of work for Africa and beyond, with plans to expand its operations globally and enhance its borderless payment alternatives. Payday currently operates in Nigeria, Rwanda, and the UK, and providing over 330,000 users with the ability to swiftly generate virtual Visa and Mastercards through its mobile application.

Pay day has raised $3 million in a seed funding round, bringing its total investment raised to $5.1 million. The funding round was led by Moniepoint Inc and involved participation from HoaQ, DFS Lab’s Stellar Africa Fund, Ingressive Capital Fund II, and angel investors such as Dare Okoudjou and Tola Onayemi.

Payday intends to use the funds to secure operational licensing in the UK and Canada and expand its operations in the UK. The neobank's growth strategy also includes influencer marketing and Twitter to connect with its target audience.

Furthermore, Payday plans to enhance talent acquisition and expand its team from 35 to 50 employees. The neobank aims to revolutionize the future of work by providing borderless payment alternatives in major currencies, making payments easily accessible to anyone on the continent.

Payday CEO and Founder, Favour Ori, expressed excitement about the funding and gratitude for the trust shown by investors. The neobank's burn rate has tripled due to its extensive marketing efforts, including the use of Twitter and influencer marketing. Payday's strategy has proven to be successful, with the app becoming the third most downloaded app on Apple's Nigerian Playstore.

Payday's partnership with Starlink in February 2023 is aimed at helping Africans purchase internet connections seamlessly and participate in the global digital economy. With its latest funding round and strategic partnerships, Payday is poised for further growth and expansion into new markets, providing secure and convenient payment solutions to individuals and businesses across Africa and beyond.

Discover the Future of Social Networking with KlubX

Are you ready to join the next big thing in social networking? Look no further than KlubX, the platform that connects you with your favorite cryptocurrencies and NFT collections. Powered by Ethereum and Web3 technology, KlubX offers a secure, anonymous, and personalized experience that puts you in control.

With just one click, you can join private Klubs and share exclusive content with other members. And unlike traditional social networks, KlubX is community-focused, so you can connect with like-minded individuals who share your interests and passions.

But that's not all - KlubX also offers real-time data and rankings, giving you insight into the value and holders of various cryptocurrencies and NFTs. Plus, with wallet-to-wallet messaging, you can chat with other owners without worrying about security.

Also According to to their recent tweets the are also giving some airdrops to their community on below conditions.

- Airdrop to those Who have Good Ether Nft balance in their Wallets.

- Airdrop to all community members who create , post , follow and interact with others posts will also get airdrop ( In Process )

- On your daily performance, your level will also increase after every 24 hour at 12.00AM UTC that will also give you a chance to get a good airdrop.

So why wait? Join the future of social networking with KlubX today. Whether you're a seasoned cryptocurrency investor or just getting started, KlubX has something for everyone. Sign up now and discover the power of Web3 and Ethereum for yourself!

Follow Below Step for Signup

- Install KlubX

- Connect your KlubX with your Digital Wallet i,e Trust wallet & Metamask Recommended.

- Create your username and small bio

- Collect your free NFT Ball and start working on KlubX

Apple Pay Later: Buy Now and Pay Later Trend That Is Changing The Game!

Apple's new feature called Apple Pay Later offers customers the option to split payments for their online purchases into four installments over six weeks, with the first installment due at the time of purchase. It is being launched amidst a growing trend of buy now, pay later services. The feature is designed with users' financial health in mind and is a great option for managing finances, but customers should use it responsibly. Apple's partnership with Goldman Sachs for loan processing ensures that the feature is secure and trustworthy.

iOS 16.4 Is it Worth To update?: Unlocking the Secrets of Apple's Latest Update

As an iPhone user, you might be wondering whether you should upgrade to the latest iOS 16.4 release.

Released just six weeks after iOS 16.3.1, iOS 16.4 packs a punch with new features and extensive security fixes. But, before you hit the upgrade button, here's what you need to know.

Compatibility: Is it the Right Fit for You?

Make or Breaks?

Features: What Makes it Stand Out?

Is it Worth To update?

AI Lawyer on Trial: The World's First Artificial Intelligence Lawyer Sued for Unlicensed Practice in the US

DoNotPay, a startup that developed the world’s first robot lawyer, is facing a class action lawsuit for allegedly practicing law without a license in the United States. The Chicago-based law firm, Edelson, filed the lawsuit on behalf of Jonathan Faridian, who used DoNotPay to draft legal documents, including a job discrimination complaint, demand letters, and small claims court filing.

DoNotPay, founded in 2015 as an app to help customers dispute parking tickets, now offers legal services using artificial intelligence (AI) to assist customers in fighting corporations, finding hidden money, and suing anyone. However, the lawsuit alleges that DoNotPay is not a robot, a lawyer, or a law firm, does not have a law degree, is not barred in any jurisdiction, and is not supervised by any lawyer.

DoNotPay’s CEO, Joshua Browder, and his company have defended AI’s ability to take up the law profession, describing it as an alternative and inexpensive solution to lawyers. But the lawyers have accused the company of being a technology firm that manipulates users and acts like a lawyer.

The court warned against using DoNotPay’s AI in its first court appearance on February 22, and the lawsuit also includes comments from several customers who complained about paying more than double the amount they should have paid to the court because of AI's advice.

The lawsuit alleges that there would have been no problem if DoNotPay described the AI as a “legal adviser” instead of a lawyer, but the company deliberately lied to market this software in a manipulative way.

DoNotPay's AI received more than 90% bad reviews on the internet and social media, prompting the lawyers to accuse the CEO of fraud by persuasion and informatics fraud.

Is DoNotPay’s robot lawyer the future of legal practice, or is it a fraud? The lawsuit raises important questions about the role of AI in the legal profession and the limits of its capabilities. While AI can assist in certain legal tasks, it cannot replace the legal expertise, ethical considerations, and emotional intelligence of a human lawyer.

As the legal profession continues to evolve, it is important to ensure that AI-based solutions comply with legal and ethical standards and are transparent about their capabilities and limitations. The lawsuit against DoNotPay’s robot lawyer serves as a reminder that innovation should not come at the cost of consumer protection and the integrity of the legal profession.

400,000 Gallons of Radioactive Water Leak from Monticello Nuclear Power Plant: Residents Raise Concerns Over Delayed Notification

The news of a nuclear power plant leaking 400,000 gallons of radioactive water in Minnesota last November has finally been confirmed. This disturbing incident at Xcel Energy’s Monticello nuclear power plant has raised concerns among residents who claim that they were not promptly informed of the potential risks.

It is alarming to note that the leak was only made public months after it occurred. The delay in notification has caused widespread fear among people living in the vicinity of the plant. The fact that radioactive water has seeped into the ground and could eventually reach the Mississippi River, a vital source of drinking water, is extremely worrisome.

While Xcel Energy has maintained that the levels of tritium in the water were below safety thresholds, the truth is that even mildly radioactive substances can pose serious health risks to humans and the environment.

According to the several new agencies, including CNBC claimed that the second leak that occurred recently only compounds the concerns and highlights the urgent need for greater transparency and safety measures in nuclear plants. Xcel Energy has announced that it will temporarily shut down the Monticello nuclear power plant to repair the recurring leak. However, the fact that the leak occurred while state regulators were monitoring the effects of the initial spill raises questions about the effectiveness of current safety protocols.

It is clear that transparency is a key issue in this situation. Residents have a right to know the truth about any potential risks to their health and safety. The delay in notification has only exacerbated concerns and led to distrust among the public. It is vital for companies to be transparent about the safety measures they have in place and to promptly inform the public of any incidents that may pose a threat.

Moreover, safety should be the top priority in any nuclear plant. Companies must invest in the latest safety technologies and protocols to ensure that incidents like this do not happen again. The fact that a second leak occurred only emphasizes the urgency of implementing these measures.

The recent incidents at the Monticello nuclear power plant highlight the need for greater transparency and safety measures in nuclear plants. The public deserves to know the truth about any potential risks to their health and safety. Companies must prioritize safety and invest in the latest safety technologies and protocols to prevent future incidents. It is time for greater accountability in the nuclear power industry to ensure that incidents like this do not happen again.

Twitter Suspends Official Arbitrum Account: Scammers Take Advantage of ARB Launch

Arbitrum official Twitter account was suspended by Twitter for On Monday. The Arbitrum is a popular Ethereum rollup platform. Arbitrum team addressed its followers by stating that the Twitter had mistakenly flagged it as spam. However, this incident raises concerns about the vulnerability of legitimate cryptocurrency accounts on social media platforms, especially with the rise of scam accounts and phishing schemes.

Twitter's suspension of the Arbitrum account has sparked controversy in the crypto community. What really happened?"

The co-founder of Offchain Labs, the company behind Arbitrum, Harry Kalodner, confirmed the suspension in a text message to CoinDesk. Although he was uncertain about Twitter's rationale, he assured that the Arbitrum Foundation was investigating the matter. Later, a representative for the foundation revealed that Twitter Support had explained that the account was flagged as spam by mistake by their system that identifies and removes multiple automated spam accounts in bulk.

The suspension of Arbitrum's official account came just days after the platform's new ARB governance token was launched, which attracted scammers and phishing schemes targeting investors. Togrhul Mahararramov, a developer for the Ethereum rollup platform Scroll, criticized Twitter for allowing scam accounts to proliferate while suspending the authentic Arbitrum account.

The suspension of a legitimate account on a major social media platform is a cautionary tale for crypto users. With the increasing popularity and value of cryptocurrencies, scammers and hackers are finding new ways to steal users' funds, and social media platforms have become a breeding ground for such activities. It is essential for crypto projects and users to exercise caution and stay vigilant against fraudulent activities.

Arbitrum is a layer 2 rollup platform that allows users to transact on the Ethereum blockchain while paying lower transaction fees. According to DefiLlama, it is currently the largest Ethereum rollup by trading volume and total value locked. The platform's DAO, which is constituted by ARB holders, took over the platform's development with the release of the token. Previously, the platform and its Twitter account were managed by Offchain Labs.

Twitter's erroneous suspension of the official Arbitrum account is a reminder of the risks that investors face in the crypto space. However, it also highlights the importance of platforms like Arbitrum in enabling efficient and cost-effective transactions on the blockchain. It is crucial that social media platforms improve their systems for detecting and responding to fraudulent activity to protect investors and prevent legitimate accounts from being suspended.

The Tragic Nashville Shooting: Why We Must Take Action to Prevent Future Tragedies

The tragic events of that day serve as a stark reminder of the urgent need for action to prevent future tragedies like this from happening again. We cannot allow innocent lives to be lost due to the failure of our society to address issues related to gun control and mental health.

- The devastating news of the Nashville shooting has left us all heartbroken and asking, "Why?"

- Why did a 28-year-old man walk into a private Christian school and take the lives of three children and three adults?

- How could someone legally purchase seven firearms despite being under care for an emotional disorder?

According to Metro Nashville Police Chief John Drake, the shooter's parents knew their son had bought and sold one weapon, but were unaware that he had purchased seven firearms. They had expressed concern to police that their son should not own weapons. This raises the question: How many more individuals are out there who should not have access to firearms, but still do?

It's time for us to have a serious conversation about gun control. We must ensure that people who are not mentally stable or have a history of violence are not allowed to purchase firearms. We need to implement stricter background checks, close loopholes in gun laws, and prevent individuals from buying weapons in bulk.

In addition to gun control, we also need to address the issue of mental health. The shooter was under care for an emotional disorder, yet was still able to legally purchase firearms. We need to invest more resources into mental health care, so that individuals who are struggling can get the help they need before it's too late.

We also need to take steps to improve school safety. The fact that a gunman was able to enter a private school and take innocent lives is a clear indication that we need to do more to protect our children. We need to invest in better security measures, such as metal detectors and more security personnel, and provide schools with the resources they need to identify and respond to potential threats.

It's important to remember that this tragedy was not an isolated incident. It was the 19th school shooting in the US in 2023 alone, and the deadliest since the May attack in Uvalde, Texas, which left 21 dead. We cannot continue to allow these senseless acts of violence to become the new normal. We must take action now to prevent future tragedies.

The Nashville shooting was a horrific tragedy that has left us all mourning for the lives lost. But we must not let our grief paralyze us. We must take action to prevent future tragedies like this from happening again. We need to have a serious conversation about gun control, invest more in mental health care, and improve school safety. Let's work together to make our communities safer for everyone.

Gary Lineker Wins £4.9m Tax Appeal Against HMRC: Victory for Freelancers or Tax Evasion?

Gary Lineker, the host of the BBC show Match of the Day, has won his appeal against HM Revenue & Customs (HMRC) over a £4.9m tax bill. The tax authorities had claimed that he should have been treated as an employee rather than as a freelancer for his work at the BBC and BT Sport, and thus was liable to pay taxes on income received between 2013 and 2018. This was under legislation called IR35, which targets disguised employees who charge for their services via limited companies. Lineker argued that all taxes were paid on his income via a partnership he set up with his ex-wife in 2012. In February, he was dragged through the papers and accused of not paying income tax, which his lawyer claimed had been paid.

According to the Sky News, Tribunal judge John Brooks found that although Gary Lineker Media (GLM) was a partnership to which IR35 legislation applies, the appeal should be granted because contracts existed between the presenter and both the BBC and BT Sport. Lineker tweeted his pleasure at the decision and said that he had always contended he had paid all his taxes and national insurance by reason of the IR35 rules.

The HMRC is considering appealing the decision, stating that the tribunal has confirmed that the off-payroll rules apply to partnerships, but it does not agree with the decision that the rules cannot apply in this case. The tax agency maintained that it is its duty to ensure that everyone pays the right tax under the law, regardless of wealth or status.

This is not the first time HMRC has gone after a broadcaster over their tax affairs. Similar cases have been made against Lorraine Kelly and Kaye Adams. Lord Birt, the former BBC director-general, also appeared before a hearing and told MPs that presenters such as Lineker should have to abide by impartiality rules, stating that their status, standing, and power arise above all else from presenting this extremely important program.

The decision in Lineker's case is a victory for him and the other freelancers in the entertainment industry. However, it also highlights the ongoing debate over employment status and the use of limited companies. The case will also affect other high-profile cases where presenters and performers have been accused of tax avoidance.

Why Tighter Regulations Won't Prevent the Next Financial Crisis: A Holistic View

World is still reeling from the global financial crisis of 2008, which led to a massive economic downturn and left many people wondering whether tighter regulations could prevent a similar crisis from happening again. While regulations can help manage risk and prevent some crises from occurring, they are not a panacea. In this blog post, we will explore why tighter regulations alone will not prevent the next financial crisis and the systemic factors that contribute to them.

Can Tighter Regulations Alone Prevent the Next Financial Crisis?

The Nature of Regulation:

Regulations can provide some stability to the financial system and prevent banks from taking on too much risk. However, they can also create a false sense of security among bankers and investors, leading to greater risks being taken than might have otherwise occurred. This ultimately makes the system more vulnerable to a crisis.

Moreover, imposing more restrictions on banks can lead to more financial intermediation taking place outside of the banking system. This makes the system more vulnerable to a crisis because the risks associated with investments are spread across a larger number of financial actors.

The Limits of Tighter Regulations:

Some might suggest that raising bank capital requirements would make the financial system safer. However, while this may make individual banks safer, it would not necessarily make the financial system as a whole safer. This is because it would likely push more financial intermediation outside of the banking system, as banks would not be able to take on as much risk.

The Need for a Holistic Approach:

To truly prevent another financial crisis, we need to take a more holistic approach. This means looking at the systemic factors that contribute to financial crises, such as the nature of financial intermediation and the ways in which financial actors respond to regulation.

In conclusion, while tighter regulations can help manage risk and prevent some crises from occurring, they are not a panacea. To truly prevent another financial crisis, we need to take a more holistic approach that addresses the systemic factors that contribute to them. Only by doing so can we build a more stable financial system that works for everyone.

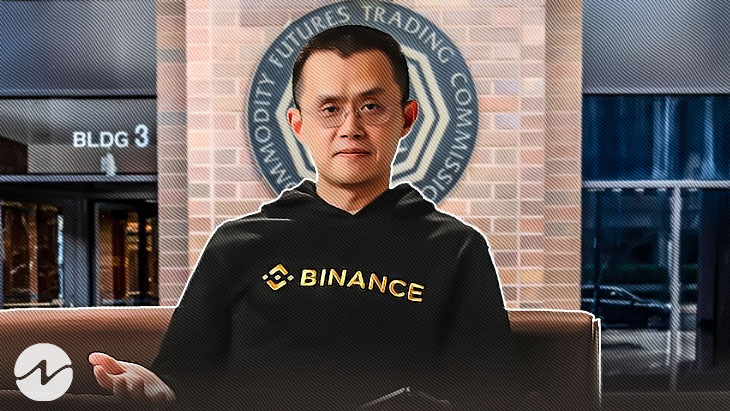

CZ's Response to CFTC Complaint: Binance's Commitment to Compliance and Transparency

World's leading cryptocurrency exchange; Binance, is facing an unexpected and disappointing civil complaint from the CFTC. Despite having cooperated with them for over two years, the complaint appears to contain an incomplete recitation of facts. At Binance, we take compliance and transparency seriously, and we believe that our efforts and commitment to the law speak for themselves.

In response to the CFTC complaint, Binance has made it clear that we take compliance and transparency seriously. Our platform has implemented best-in-class technology to ensure compliance, including mandatory KYC programs that are among the highest standards in the world. We also have comprehensive measures in place to block US users, including by nationality, IP, mobile carrier, device fingerprints, and more.

Furthermore, Binance is committed to cooperation and transparency with regulators and law enforcement agencies around the world. Our compliance teams have handled over 55,000 law enforcement requests, and we have assisted US LE in freezing/seizing more than $285 million in funds since 2022.

Binance holds the highest number of licenses and registrations globally, and we are well-regarded by our user community. We do not trade for profit or manipulate the market, and we have strict policies in place to prevent our employees from doing so as well. Our focus is on building a solid platform that serves our users, and we believe in doing the right thing by them at all times.

In this journey towards freedom of money, Binance recognizes that challenges and obstacles will arise. However, we are committed to finding amicable solutions to all problems and collaborating with regulators and government agencies all around the world.

Binance's response to the CFTC complaint is a testament to our commitment to compliance and transparency. We believe that our platform and policies speak for themselves, and we are confident in our ability to continue serving our users while upholding the highest standards of the law.

CFTC Sues Binance for aIlegation of Law Suit: A War Between CZ and CFTC?

The Commodity Futures Trading Commission (CFTC) has filed a lawsuit against cryptocurrency exchange Binance, as well as its CEO Changpeng Zhao and another executive, alleging that they have participated in illegal activities and violated US trading laws. The complaint accuses Binance of market manipulation by using more than 300 House Accounts to trade on their own exchange without proper disclosure to customers. The CFTC is seeking fines and a ban on participation in commodity trading for the company and its executives. CFTC also claimed Binance keeping their Information as a Top Secret and not even responding to Commission issued investigatives.

- This development has garnered significant attention from the cryptocurrency community and investors alike.

- The CFTC's lawsuit against Binance and the other entities may have far-reaching implications for the cryptocurrency industry and its regulation.

Have you ever wondered: Who Controls the Internet, How it Works

Think of the internet as a vast web, made up of millions of devices, including smartphones, computers, and servers. Each device represents a thread, and when woven together, they create a powerful network that spans the globe.

- But what happens when a few threads are cut?

- Does it affect the network as a whole?

Surprisingly, The answer is no. The internet is incredibly resilient, and there are always alternative ways to build connections. Even when a region is cut off, there are multiple routes for data to flow.

Telecommunication Companies?

While many people might assume that internet providers like AT&T, Verizon, T-Mobile or any broadband servicing providers of the country hold the power, this is not entirely true. Even if one company stopped providing internet, there are plenty of other options available. Similarly, while governments might have the power to block websites or remove Facebook posts, this does not amount to control over the internet as a whole.

Tech Giants?

You might think that companies like Google, Facebook, or YouTube have the most power since they have vast amounts of data. However, this is not true either. Anyone can build their website, and these companies cannot interfere. So, who is providing space for these websites to exist in the first place?

Domain Providers?

To create a website, you need to buy a domain name from a website like Google Domain. But who gave Google Domain the authority to sell domain names? That is where the Internet Corporation For Assigned Names And Numbers (ICANN) comes in. ICANN is a non-profit organization based in Los Angeles that decides which websites can sell domain names and which domain names can exist. They even sell top-level domain names to companies through bidding.

ICANN?

However, even ICANN is not to be said the ultimate boss of the internet. The internet is a decentralized network, much like a net. All the computers and mobile phones that are connected make up the internet. They are connected to each other through wires, including the huge underwater cables that have been laid across continents. Even mobile phones are connected to wires, although they operate through mobile towers that connect to wires.

ISPs?

The companies that lay down these wires and the internet service providers (ISPs) that connect us all hold significant power. They supply internet to many different places and connect your computer to the internet worldwide. So while no single entity controls the internet, many companies and organizations play important roles in keeping us all connected.

Its a Decentralized Network: No one controls the internet

Understanding how the internet works is essential, especially as it becomes more critical to maintaining freedom and democracy worldwide. As we've seen in countries like China, where the government blocks citizens from certain websites to brainwash them in a particular way, access to the internet is crucial.

The internet is a complex web of connections that no one single entity controls, the internet is a decentralized network that remains free from any single controlling entity. From domain name sellers like Google Domain to non-profit organizations like ICANN to internet providers and cable companies, many different entities play a role in keeping us connected. Understanding these connections is crucial to understanding the power dynamics at play in the world of the internet. This decentralized nature of the internet is crucial in promoting freedom and democracy worldwide. It allows individuals and communities to access and share information without centralized control or censorship.

Why Russia Sold Alaska to the United States: A Historical and Strategic Perspective

Alaska was formally transferred from Russia to the United States On October 18, 1867. Contrary to what some may think, the Americans didn't steal or invade Alaska; the sale, in fact, was on good terms, and both sides had reason to do so. Russia sold Alaska for a total of 7.2 million dollars, and considering that Alaska is the largest state in the United States, with a current GDP of 50 billion dollars, one would think that there is no reasonable explanation as to why Russia sold such a large territory for so little money.

- So, why did Russia really sell Alaska?

- Why didn't everyone in the United States agree to the purchase?

- And why has Alaska been in recession the last few years?

Russia's motives for selling Alaska ranged from financial and strategic to political.

Financial Motive

First, it turns out that early Russian traders were attracted to Alaska by the walrus ivory and sea otter pelts that could be obtained by trading with the indigenous peoples of the region. This trade was carried out by the Russian-American company created by Russian businessmen. The company controlled all the mines in Alaska; it could make trade agreements with other countries independently, and had its own flag. All these privileges were granted to the company by the Russian government, as it not only collected taxes but also owned a large part of it. The tsars and their relatives were among the shareholders. However, by the 1990s, the sea otter population was almost extinct, and as a consequence, financial difficulties arose for the Russian company. It was on the brink of bankruptcy and could not continue without large subsidies. Having the government take over the entire Alaskan colony would cost Russia a lot of resources. Thus, selling Alaska seemed like an increasingly reasonable option.

Strategic Motive

Alaska was too vast and remote a place to be defended by Russia. Russian leaders themselves recognized that they were not in a position to defend Alaska if their enemy of the time, the United Kingdom, attempted to attack. Keep in mind that the eastern part of Russia is inhospitable and unpopulated, and that the distance between Saint Petersburg, the Russian capital at the time, and Alaska was several weeks by boat. Russia couldn't even defend its territory when foreign fishermen came to hunt in its waters because its navy was not strong enough to patrol all the waters of its remote Alaskan colony.

Political Motive

Russia and the United States were allies at the time. Both shared a certain rivalry with the United Kingdom. For Russia, the sale of Alaska to the United States would weaken the power of the United Kingdom on the Pacific coast. In other words, if the United States became the owner of Alaska, Russia would thus avoid future aggression from British Oregon. This was one more reason to sell Alaska. Edward de Stockel, Russia's representative in Washington, started talks with U.S Secretary of State William Seward. The two agreed on the treaty transferring Alaska, which months later would be ratified by the U.S Senate.

Russian leaders expected that sooner or later, the United States would aim to dominate North America and take Alaska from them. From Russia's point of view, the United States would continue to expand because it was in its manifest destiny, just as they had done with Texas, New Mexico, and other parts of the south. Therefore, it was better to get some reward by selling Alaska and to be on good terms than to settle Alaska's fate in the future in a less friendly way.

The Era Of Cheap Labor in China is Coming to an End: What Does it Mean for the World?

Steve Jobs introduced the iPhone in 2007, at the time Chinese labor cost about one US dollar less than Thailand or the Philippines, and Malaysia. Fast forward 15 years, and wages have increased nearly everywhere, but China is in a league of its own. By the time the iPhone 14 was released last year, the cost of labor had gone from one to eight dollars. Today, for the price of one hour of Chinese labor, you can buy 4.5 in Mexico. In fact, the only major Latin American economy with a higher cost is Chile. Not only is made in China no longer cheap globally speaking, you might even say it's expensive.

China's Aging Population Poses a Threat to Economic Growth

As the demographic transition progresses in China, the population is aging rapidly, and the country is facing a labor shortage. The number of people entering the workforce is declining, while the number of retirees is increasing, which will put a strain on China's economic growth.

China's Shift from "World's Factory" to Higher-End Products and Services

Moreover, with rising wages in China, it is no longer the cheapest place to manufacture goods, and other countries such as Vietnam and Bangladesh are becoming more attractive to manufacturers. As a result, China's role as the "world's factory" is changing, and the country is now focusing on developing higher-end products and services.

Challenges and Opportunities for China's Continued Economic Success

Rise of China as an economic superpower over the past few decades was fueled by a combination of factors, including the one-child policy, the demographic dividend, and cheap labor. However, as China's economy matures, it is facing new challenges such as an aging population, a labor shortage, and rising wages. Despite these challenges, China's economic growth remains robust, and the country's continued success will depend on its ability to adapt to these changing conditions.

Who will be the Next Global Superpower? : China "or" Russia "or" India.

World is on the cusp of a major shift in global power. The question on everyone's mind: who will be the next superpower?".

In the world of geopolitics, power is constantly shifting. And with the rise of new players on the global stage, the balance of power is about to be upset once again."

For decades, the United States has reigned supreme as the world's sole superpower. But as we look ahead to the future, it's becoming increasingly clear that a new contender is emerging. With tensions rising between traditional powers and the ascent of new players, the world is at a crossroads. Who will emerge as the victor in the struggle for global dominance. The Recent Development in Global trade is indication of Collaboration economy, where the superpowers will be emerge from collaborations.

Predicting the next superpower is a complex issue, and there is no clear answer. While China, Russia, and India are all contenders, each country faces its own unique challenges and advantages. Ultimately, the country that becomes the next superpower will depend on a range of factors such as economic growth, political stability, military power, and technological advancements. While there are several countries that could potentially become the next superpower, the three countries that are most commonly discussed are China, Russia, and India.

China: The Rising Giant

China's impressive economic growth and technological advancements make it a strong contender for the next superpower. With a population of over 1.4 billion people, China has a massive workforce that can drive economic growth and innovation. Its political system has also been highly effective at implementing long-term plans and policies, which has helped to sustain its economic growth. China's investments in cutting-edge technologies such as artificial intelligence and quantum computing also demonstrate its commitment to staying ahead of the curve. By highlighting these points, you can make a persuasive case for why China is the most likely candidate for becoming the next superpower.

Russia: The Military Powerhouse

Russia's military power and significant natural resources make it a formidable candidate for becoming the next superpower. Its highly centralized political system allows for rapid decision-making and implementation of policies, which can give it an edge in strategic planning. Additionally, its advanced military capabilities and vast natural resources such as oil and gas give Russia significant geopolitical influence. By emphasizing these strengths, you can make a persuasive case for why Russia is a strong contender for becoming the next superpower.

India: The Democratic Alternative

India's impressive economic growth and democratic political system make it a compelling candidate for becoming the next superpower. Its highly educated workforce and stable political system provide a solid foundation for sustained economic growth. Additionally, India's democratic values and institutions give it an edge over countries like China and Russia, which have more authoritarian political systems. By highlighting these strengths, you can make a persuasive case for why India could be the next superpower.

The Dollar's Reign is Under Threat: 5 Threats to Dollar that Could Shake The Global Trade

According to several critics, News agencies including; Business Insider, the US dollar's position is increasingly under threat from emerging rivals and alternative currencies. Several countries are pushing plans to increase the use of alternative currencies. Nations from China, Russia, India, Brazil, and others are pushing for settling more trade in non-dollar units, from local currencies to a gold-backed stablcoin and a new BRICS reserve currency. Here are five rising challenges to the greenback's dominance of international trade and investment flows.

1- The rise of cryptocurrencies

Cryptocurrencies, such as Bitcoin, are becoming more widely accepted, and some people believe that they could eventually replace traditional currencies. Bitcoin is already used for cross-border payments, and some businesses are accepting it as payment. If cryptocurrencies become widely accepted, they could undermine the dollar's dominance in international trade.

3- Russia and Iran eye on a gold-backed stablecoin

Russia and Iran are working on a cryptocurrency backed by gold, a 'stable-coin' that could replace the dollar for payments in international trade. The two countries, which have been hit by Western sanctions, want to issue a "token of the Persian region" for use in cross-border transactions, with a plan to launch it in a special economic enclave in Astrakhan in southern Russia, which already handles Iranian shipments. However, the project can only move forward once Russia's market for digital assets is fully regulated, according to a Moscow lawmaker. Russia and Iran have stepped up their push to "de-dollarize" in recent months, according to think tank the Jamestown Foundation.

3- UAE and India look at using rupees in non-oil trade

The UAE and India have floated the idea of conducting non-oil trade in rupees. This move would build on a free trade agreement signed last year, which aims to boost trade excluding oil between the two countries to $100 billion by 2027. China has also pondered on the idea of settling non-oil trade in local currencies that exclude the greenback, according to minister of state for foreign trade of the UAE Thani bin Ahmed Al Zeyoudi.

4- China pushes for the yuan to replace the dollar in oil trades

China is looking to weaken the dollar by pushing for the yuan to replace the greenback in oil trades. The move could reduce China's dependence on the US currency and provide a way for other countries to avoid using the US dollar. China has already made progress in this area, with many oil-producing countries, including Russia and Iran, already using the yuan in oil trades.

5- Brazil and Argentina plan a common currency

Brazil and Argentina have recently announced that they are planning to launch a joint currency, named the "sur" (south), that could eventually become a euro-like project embraced by all of South America. The move could help boost South American trade, because it would avoid conversion costs and exchange rate uncertainty. According to the Federal Reserve, the US dollar accounted for as much as 96% of the trade between North and South Americas from 1999 to 2019.

Dubai's D33 Agenda: The Path to Becoming a Global Financial Hub

Dubai has recently launched its new economic agenda; "D33", with the aim to double the size of its economy within the next decade. The agenda will drive economic growth in the emirate and attract foreign direct investment, high net worth individuals, and billionaires to enjoy a quality lifestyle in one of the best modern cities in the world. With the increase in population, local consumption is bound to increase, and the local economy is expected to flourish.

Dubai's Ambitious Economic Agenda: Doubling its Economy in a Decade

Dubai's recently launched economic agenda, "D33", has set an ambitious target to double the size of its economy within the next decade. This economic plan aims to attract foreign direct investment, high net worth individuals, and billionaires to the city and increase local consumption to boost the economy.

Strengthening Dubai's Position as an International Financial Hub

Dubai has always been known for its excellent infrastructure and safe environment, and the new economic agenda aims to further strengthen its position as an international financial hub. The government has taken several measures in the last few years, such as long-term visas, regulatory compliance measures, and amending laws, to make Dubai even more attractive to investors and entrepreneurs.

Dubai's Vision for the Future: Becoming a Major Player in the Global Economy

With an aim to double foreign trade to AED 25 trillion and add 400 new cities to its trading network, Dubai's ruler, Sheikh Mohammed, aims to position Dubai as one of the top four global financial hubs in the world. Dubai is set to attract over AED 700 billion in foreign direct investments in the next 10 years, which will be a significant boost to the economy.

Dubai's Favorable Business Environment: A Promising Destination for Investors

Dubai has a favorable business environment, with tax-free zones, easy company registration, and a strategic location at the crossroads of Europe, Asia, and Africa. The city has invested heavily in infrastructure and technology to support the growth of the financial sector. Dubai's focus on innovation, strong regulatory framework, and growing fintech industry make it an attractive destination for businesses and investors looking to tap into the region's wealth and potential.

Overall, with its visionary economic agenda, favorable business environment, and strategic location, Dubai has the potential to become a major global financial hub in the coming years. The city's focus on innovation, technology, and infrastructure will help drive economic growth, attract foreign investment, and make Dubai a preferred destination for businesses and investors.

The Collapse of Silicon Valley Bank and Signature Bank's : Another Financial Crisis After 2008?

The collapse of two major American banks, Silicon Valley Bank in California and Signature Bank in New York, has caused shockwaves throughout the business world. This is the second biggest banking failure in American history, second only to the 2008 collapse of the Washington Mutual Bank. While the Washington Mutual Bank crisis was due to irresponsible housing loans, the recent collapse of Silicon Valley Bank (SVB) and Signature Bank are due to a combination of factors, including the Covid-19 pandemic and heavy investment in tech startups and venture capital.

The Tech-Focused Bank That Took the Startup World by Storm

Silicon Valley Bank (SVB) was a unique player in the world of banking. Unlike other banks that looked for diversified customers, SVB focused almost exclusively on technology-based startups. By 2015, SVB had expanded so much that 65% of all startups in America were served by the bank. By the end of 2022, it had become the 16th biggest lender in America, with total assets valued at $209 billion. But then came the Covid-19 pandemic, and with it, SVB's problems began.

A Wake-Up Call for Startups on SVB's Collapse

In March 2021, the value of total deposits with SVB was around $124 billion, compared to $62 billion the year before in 2020. Then, disaster struck. SVB crashed, causing panic in the startup community. Many companies had deposited their funds with the bank and may have lost a significant amount of money. The American government had to step in, handing over the receivership of the bank to the FDIC and using customer deposits to create a new bank. Now, there's talk of a potential merger to salvage the situation, similar to what happened when the PMC bank crashed in India.

The Impact of SVB's Collapse

The crash of SVB has undoubtedly had an impact on the affected startups and the stock market. However, experts do not predict a global financial crisis like the one in 2008. Nonetheless, this serves as a reminder to individuals and companies to be cautious with their investments and diversify their banking options. The collapse of SVB and Signature Bank shows that even the most reputable banks can fail, and individuals must be vigilant in protecting their assets.

Lessons Learned?": Diversification and Vigilance Are Key

This recent collapse of Silicon Valley Bank and Signature Bank is a reminder of the fragility of the banking system and the importance of diversifying investments. While the American government is taking steps to mitigate the impact on affected parties, it is crucial for individuals and companies to take proactive measures to safeguard their financial interests. Whether it's investing in a range of banks or spreading investments across different asset classes, diversification is key. And, in the current climate of economic uncertainty, it's never been more important to stay vigilant and protect your assets.

Overall, the collapse of SVB should be seen as a wake-up call for startups and investors alike. While the impact may not be felt on a global scale, it serves as a reminder of the importance of diversification, vigilance, and caution when it comes to managing your finances. By taking proactive steps to protect your assets, you can weather any storm that may come your way.

The Great Recession 2.0? The World Economic Forum's Chief Economist Outlook for 2023.

According to the World Economic Forum's Chief Economist Outlook for 2023 indicates that the global economy is near to a recession period, 20% of respondents predicted global recession in World Economic Forum. However there are some bright spots, including easing inflation and improving consumer sentiment . The outlook varies across the regions, some countries expect to grow in recession, whereas other will suffer from this recession.

The Western regions of the Globe, including United States are poised to be at the center of this upcoming economic recession, that was initially started with surge in demand after the Covid-19 pandemic, coupled with short supply and an increasing inflation rate. This unfortunate series of events has led to the onset of this recession. Furthermore, recent layoffs of large tech companies in Silicon Valley are considered to be a significant milestone of this recession, resulting in the collapse of several banks in the region. Moreover, U.K's industry is already on life support, as its imports make only a negligible contribution to the economy. Meanwhile the European nations are grappling with a recession that is manifesting in the form of soaring prices, inadequate energy supplies, and inflation. The root cause of this downturn is the Russia-Ukraine war. A recent report indicates that 90% of the respondents believe that the United States, the United Kingdom, and the European Union will bear the brunt of the upcoming recession.

Global economic downturn is expected to have varying impacts on different regions, with Asia emerging as the region that stands to gain the most. However, the degree of growth is expected to vary across sub-regions, with some experiencing strong growth while others experience only moderate growth. The Middle East is projected to be the biggest beneficiary of the recession, with countries such as the UAE, Oman, Qatar, and Saudi Arabia all predicted to experience strong economic growth during this time. South Asian and Southeast Asian nations are projected to experience moderate growth, with emerging economies like India, Bangladesh, Vietnam, the Philippines, Malaysia, and Indonesia leading the way. However, East Asian countries such as China and Japan, may face significant challenges due to their heavy dependence on Western trade, which is likely to be adversely affected by the impending recession.

Zksync 2.0 $500 to $5000 Airdrop to Grab

The first zkEVM on Ethereum is revolutionizing the blockchain space, and it's time to take advantage of the biggest airdrop in history. In this blog, we will guide you through the steps to grab this opportunity and join the crew of this groundbreaking project. From setting up a Metamask wallet to minting your own NFT, we've got you covered.

Below are the Steps to Grab a big Airdrop of History , zkSync layer 1 was working from 2022 where as layer 2.0 is on our door step to be eligible for airdrop we need to follow the Below Process.

Step 1: Buy Ethereum from Binance

Step 2: Withdraw Ethereum Erc20 to Metamask Wallet

Step 3: Bridge Ethereum ERC20 in Zksync

Step 4: Transfer Zksync to Ethereum ERC20

Step 5: Swap Some Amount

Once the transfer is complete, swap some amount to continue the process.Step 6: Mint Your Own NFT

Step 7: Join the Zksync Crew

Testnet Projects

Elon Musk Idea about Fed Interest Rates.?

Musk also shared his idea that fed should have to make meeting FOMC meeting and that happened on tuesday. After the end of two days in meeting FOMC is Expected to lower the Fed rates.

Bitcoin Crossed $28000 , Do You Guys Think Bitcoin is Safer than Banks?

- Investors and analysts are saying that Bitcoin is a great investment for those who are looking for risky assets.

- Why? Well, a few things have happened recently that are causing uncertainty in the traditional finance world.

Three US Banks Close: Implications for the Economy

First, three US banks have closed, which is never a good sign for the economy. Second, Swiss bank Credit Suisse was taken over by its rival UBS, causing even more turmoil in the financial world. And lastly, the Federal Reserve is going to make a decision on interest rates very soon, which is causing some investors to worry.Increased Demand for the Dollar Boosts Bitcoin

Senior Analyst Insights: Wall Street and Bitcoin

Popular Posts

-

The first zkEVM on Ethereum is revolutionizing the blockchain space, and it's time to take advantage of the biggest airdrop in history. ...

-

Sui is a revolutionary permissionless Layer 1 blockchain that enables creators and developers to build rich and dynamic on-chain assets. The...

-

As an iPhone user, you might be wondering whether you should upgrade to the latest iOS 16.4 release. Released just six weeks after iOS 16.3...

-

Are you ready to join the next big thing in social networking? Look no further than KlubX, the platform that connects you with your favorite...

-

World's leading cryptocurrency exchange; Binance, is facing an unexpected and disappointing civil complaint from the CFTC. Despite havin...

-

According to the World Economic Forum's Chief Economist Outlook for 2023 indicates that the global economy is near to a recession period...

-

Elon Musk is a billionaire entrepreneur, inventor, and CEO of Tesla and SpaceX, who has gained notoriety for his unique approach to communic...

-

Dubai has recently launched its new economic agenda; " D33", with the aim to double the size of its economy within the next decad...

-

According to the CNBC , The US economy has been experiencing a period of turbulence in the banking sector, and experts are concerned that it...

-

Artificial Intelligence (AI) is one of the fastest-growing and competitive markets in the tech industry. The creation and deployment of AI m...

- April 2023 (22)

- March 2023 (28)